This website’s purpose is to educate, not give investment advice. Marketing are very unstable and risky investments. You should think about your investment experience, financial situation, investment goals and risk tolerance, and talk to an independent financial adviser before investing. Also, please keep in mind that the data given here about the cryptocurrency (like its current live price) comes from third party sources. There is no guarantee that you will make any money back from investing.

A non-fungible token is indeed a cryptographic token that represents something unique and has a distinguishing feature. Owning an NFT is similar to owning a one-of-a-kind piece of art or a valuable antique. According to some analysts, NFTs have the potential to define the direction of Blockchains, and that is why they are gaining popularity among users and enthusiasts. Let us peep more into the basic definition of NFTs and exactly do they work

What are Non-Fungible Tokens?

“Non Fungible Tokens are sort of tokens that cannot be exchanged with other tokens and are not interchangeable.” This unique peculiar characteristic makes it more demanding and trending rapidly. A US dollar, for instance, can be exchanged for any other U.S dollar. Additionally, you can utilize it for British currency or any other currency. That is what fungibility is all about.

All major cryptocurrencies, such as Bitcoin and Ethereum, have fungibility or interchangeability as a basic characteristic. NFT, on the other hand, has developed as a new form of kitty currency with its own set of characteristics.

It’s a digital token that you produce to use cryptography to authenticate the legitimacy and possession of an item. For instance, if you have a digital property, such as a digital work of art, you can tokenize it with a Non Fungible Token. The NFT you currently hold signifies that you are the sole owner of the artwork. It is non-transferable because your artwork is one-of-a-kind and that’s what makes NFTs unique and desirable among all.

Creator of NFT?

Witek Radomski, the founder of Enjin Coin, produced the very first NFT in June 2017 when he created the code for the very first coin. The code, nevertheless, was made public two months later, in August. The most widely used model for fungible tokens is ERC-20, which is modeled on Ethereum. Non-fungible tokens, on the other hand, use a distinct set of standards, such as ERC-721, which is based on Ethereum, or ERC-1155, which in its latest version, or a different set of standards built on the NEO blockchain platform system.

Non Fungible Token Uses

A. Gaming: The game CryptoKitties, which was centered on the blockchain, was one of the earliest uses, in reality, the game exposed the notion of NFTs to the public. You gather, buy, breed, and trade digital kittens in this game built on the ETH Blockchain & ERC-721 standard. Each digital kitty has its peculiar genetic qualities secured on the blockchain. There is a distinction in ERC-721 and ERC-20 tokens, which is the Ethereum network’s standard protocol. ERC-721 denotes a whole class of assets, whereas ERC-20 denotes a specific type of asset. Within a year, the game had amassed such a following that sales had surpassed USD 12 million. Similarly, Decentraland, a game about virtually scarce land, is another prominent example. Non Fungible Tokens can be used to buy, develop, and sell land in Decentraland. You have complete control over your land; you may create whatever you want on it, make it distinctive, and increase its worth. The game makes use of a 360-degree virtual world to give the impression that you are actually in the actual world. Several other games based on the same concept and using NFT have since appeared. Non-fungible Tokens have opened up a world of opportunities for the gaming world, which is already growing in terms of income and growth. People can now own, purchase, and sell gaming characters using NFT.

B. Collectibles: The utilization of these tokens to retain digital assets in your digital account is the key aspect of NFTs. The use of digital art as an example has already been considered. To make any virtual asset distinctive you can build an NFT. In other ways, NFT provides irrefutable ownership of both in-game assets and virtual products. It is quite viable that in the not-too-distant future, it will be used for tangible asset ownership, such as homeownership. In reality, NFTs from physical collectibles are helping to strengthen asset-backed securities, according to a recent Forbes article.

C. Licensing: Another fantastic example of how NFT may be used effectively is in software licensing. Creating NFT-based licenses, according to experts, can reduce piracy and allow consumers to sell their licenses on the open market for a profit. People can also avoid annual subscriptions by using software under the terms of the acquired license and then selling it to somebody else. In this scenario, the license serves as a benefit for users. Software developers can gain as well because they can construct smart contracts that allow for-profit sharing on resale or anything that generates cash for the original creator. NFT offers both developers and users a win-win situation. It has the potential to curb piracy while also providing other benefits.

Investors Have a New Opportunity Owing it to NFTs

NFTs have been widely used for this reason in recent months. Many people are tokenizing digital art or other digital items, which are frequently nothing more than meaningless garbage, in order to create value.

However, a more productive application of NFTs is gaining traction and is predicted to become widespread in the coming years. This is the process of tokenizing tangible and valuable virtual assets, such as artwork and memorabilia, and converting these into tokenized securities. This opens up new investing opportunities. To put it another way, tokenizing tangible assets allows investors to increase their liquidity. Also, please remember that NFT is a relatively new phenomenon with a variety of applications.

Non Fungible Tokens List

- Non Fungible Tokens for Stellar: Another prominent decentralized Blockchain-based system is Stellar, which permits users to send funds to any location on the planet. The platform is one of the most cost-effective methods of sending money to everyone, in any country, and in real-time. They’ve only recently begun to use NFTs as well. Each individual Non-Fungible Token is represented by a Stellar account. Before being put on an IPFS object, each token uses unique metadata to identify itself from the other, and it is validated by the account creator. In exchange, the IPFS multi hash is utilized as the account/user linked with the token’s secret key. Keep in mind, however, that unlike other types of NFTs, they are not tradeable on Stellar.

- Non-fungible Tokens for EOS: ERC-721 & ERC-1155 NFT standards, which are used on Ethereum, have already been mentioned. Is there any EOS Non-Fungible Token? UNICO and EOS Cafe Calgary teamed up a few months ago to produce the NFTs Standard for EOS. Developers can now create NFTs on the EOS blockchain, in addition to the Ethereum and NEO blockchains.

- Non Fungible Tokens for NEO: On the NEO Blockchain network, a leading Chinese contract platform, various teams are seeking to enhance Non Fungible Token standards. Da Hongfei, the CEO of NEO, expressed his interest in the non-fungibility of tokens in a recent interview. He also stated that they will be working on a standard for NEO that is similar to ERC-721 just on the Ethereum platform. “We merely had a standard to get certified,” Hongfei remarked in one of his statements in July 2018. It will be incorporated into the main branch of the project. NEO is likewise pursuing non-fungible tokens as a strategy. Collectibles are created when gaming meets blockchain. It’s a natural match since such collectibles can be exchanged on blockchain”. David Li, the inventor of Trinity Protocol, introduced his NEP-10 protocol for NFTs on the NEO platform in March 2018. The NEP5 specification, which is used to create fungible tokens on NEO, is not the same as this new standard.

How to buy Non Fungible Tokens

Non Fungible Tokens can be bought on numerous non-fungible tokens marketplaces such as SupeRare, OpenSea, and Raible. The following steps are to be followed while purchasing Non Fungible Tokens:

- Step 1: Go to Rarible’s website by clicking the ‘Connect’ button in the upper right corner. Log in using the account you want to link to the platform from here. Before you can log in, you must first agree to the terms of service. We would use Metamask, a prominent web and mobile wallet.

- Step 2: Once you have logged in, look through the site for the Non-Fungible Token you want to buy. Regardless of the NFT you want to buy, the procedure will be the same. Press the ‘Purchase now’ button after you’ve chosen the NFT you want to buy.

- Step 3: A verification window will appear, prompting you to cross-check the order’s details. To go to the final step, hit the ‘Proceed to pay’ button if you’re happy to do so.

- Step 4: When you click on your wallet, a window will appear requesting you to approve the transaction. If you want to proceed, simply confirm the payment and it will be completed. Your Non Fungible Token will be deposited immediately to your ETH address and would be yours to hold once it has been validated.

Popular Non-Fungible Tokens Marketplaces

There are many NFT websites to choose from once you have established and funded your wallet.

- OpenSea: It is a peer-to-peer marketplace that sells “rare digital items and memorabilia.” To get started, simply create an account and browse the NFT collections. You may also arrange pieces by how much they sold to find new artists.

- Raible: It is a liberal, accessible marketplace that permits artists and innovators to issue and trade NFTs, much similar to OpenSea.

- Foundation: Artists must earn “upvotes” or an invite from similar creators to put their work on the foundation. The exclusivity of the group and the cost of membership. Because of the community’s exclusivity, artists must also acquire “gas” to mint NFTs—it is evident to attract higher-quality work. Chris Torres, the developer of Nyan Cat, for example, marketed the Non-Fungible Token on the Foundation marketplace. It might also imply higher prices, which isn’t necessarily a negative thing for creators and collectors looking to profit if demand for NFTs stays the same or even rises over time.

Although these platforms are home to thousands of NFT artists and collectors, do your research properly before purchasing. Some artists have been defrauded by scammers who have advertised and marketed their artwork without their knowledge.

Furthermore, the verification methods for artists and NFT postings vary by platform, with some being more stringent than others. For NFT listings, both OpenSea and Rarible do not need owner verification. Buyer safeguards seem to be limited at best, therefore it is certainly prudent to remember the old adage “caveat emptor” when looking for NFTs.

Examples of NFT?

- Domain Names

- Sneakers

- Games

- Essays

- Digital Collectible

Should you Buy NFT or not?

Frankly speaking, NFTs are dangerous since their future is unknown, and we don’t yet have enough data to gauge their performance. Because NFTs are so novel, it would be worth spending a little amount to test them out for the time being. Investment in NFTs is certainly a personal decision. If you really have some extra cash, it is something to think about, especially if the artwork has relatable value for you.

However, keep in mind that the value of an NFT is solely determined by what somebody else is prepared to spend for it. Keep in mind that NFTs, like the cryptocurrencies that are used to buy them, may be subject to taxation. Withholding tax on transfers of online virtual assets which does include NFTs & cryptocurrencies, was suggested in the Indian Budget 2022 and would take effect on July 1. There is also talk of tax deductions at the very source. Because it is unclear how the tax will work, you should consult a tax specialist before thinking of incorporating NFTs into your investment.

However, treat NFTs as you would any other investment: do your homework, understand the dangers including the possibility of losing all of your invested rupees, and continue with prudence if you choose to bite the bullet.

Why are Non-Fungible Tokens getting so prominent?

Although NFTs have been present since 2015, they are currently witnessing a surge in popularity due to a number of variables. The first, and arguably most evident, is the normalcy and enthusiasm surrounding cryptocurrencies and the blockchain frameworks that underpin them. Beyond the technology, there is a combination of the fanbase, royalties economics, and scarcity laws. Certainly, Consumers all expect action when it means owning unique digital property and even holding it as an investment.

Whenever anyone purchases an NFTs token, then they become the owner of the material, but it can still be shared on the Internet. An NFT can grow in popularity in this way since the more this can be seen publicly, the more worth it creates. When an asset is sold out, the initial inventor receives a 10% cut, with a tiny part going to the platform and the rest going to the current owner. As a result, as popular digital assets are traded over time, there is the possibility for recurring revenue.

When it comes to NFTs, authenticity is key. Because of the blockchain, digital collectibles have unique information that distinguishes them from other NFTs and makes them easily verifiable. Fake collectibles cannot be created or circulated since each object can be identified back to its original maker or issuer.

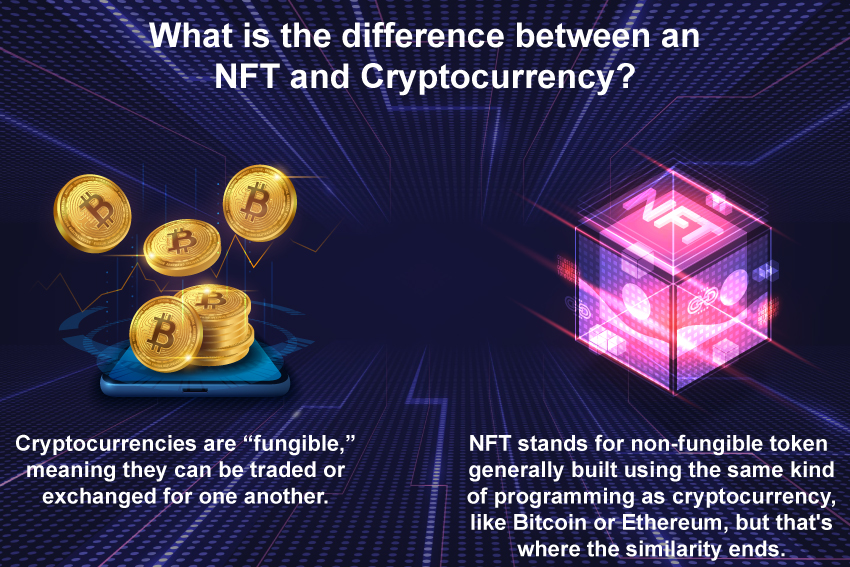

What is the difference between an NFT and Cryptocurrency?

Non-fungible tokens, as previously said, are non-fungible tokens. It is usually programmed in the same way as cryptocurrencies such as Bitcoin or Ethereum, and that is where the similarities end.

Cryptocurrencies and physical money are both “fungible,” meaning they may be swapped or replaced for one another. They are also worth the same amount of money: one dollar always equals another dollar, and 1 Bitcoin is always worth another Bitcoin. The interchangeability of cryptocurrency makes it a safe medium to permit blockchain transactions.

NFTs aren’t like other materials. Each NFT contains a digital signature that prevents NFTs from being replaced and so are non-fungible.

How does Non-Fungible Token Work?

NFTs are stored on a blockchain, which is indeed a decentralized public ledger that keeps complete track of transactions. Most users are aware about blockchain as the fundamental technology that allows cryptocurrencies to exist.

NFTs are most commonly kept on the ETH blockchain, however, they can also be held on other blockchains. An NFT is made up of digital entities that symbolize both intangible and tangible objects, such as:

- GIFs

- Art

- Highlights from sporting events and videos

- Collectibles

- Skins for video games and virtual avatars

- Sneakers by a designer

- Music

Even tweets are taken into account. Jack Dorsey, a co-founder of Twitter, sold his first post as an NFT for over $2.9 million. NFTs are basically virtual versions of tangible collector’s artifacts. Rather than purchasing an oil painting to place on the ceiling, the couple decided to create their own. They also obtain exclusive rights to the property. NFTs can only have one user at a time. Because NFTs include unique data, it’s simple to verify ownership and exchange tokens between owners. They can also be exploited to hold specific detailed information by the owner. Artists can sign their assets by marking their signature on the metadata of an NFT.

Bright Future of Non-Fungible Tokens

As more practical applications of Non-Fungible Token emerge and become more mainstream, more people would tokenize their digital assets and physical assets on Blockchain and our NFTs are definitely required for the same purpose. As we have already discussed how it could be used in the gaming sector, software licensing, and storing collectibles. NFTs can also be used to verify identity and even ownership of items.

Another potential is that it will be used in the financial sector to tokenize conventional assets such as precious metals, equities, and bonds. It will be determined by the future movement of these high-value commodities to the blockchain. NFTs can also be used to store educational qualifications, birth records, identities, and warranties in an immutable and secure manner and whatnot. Although the applications for this new sort of token are being developed, it is becoming increasingly popular because of its utilization in games, particularly for marketing in-game assets such as CryptoKitties. Users are now ready to pay thousands of millions of dollars on Non Fungible Tokens due to their growing popularity. Many professionals in the crypto sector, like David Gerard, believe that about 40% of novel crypto users will choose NFTs as their point of entry. NFT may become a larger element of the new age of the digital economy in the future for sure to its growing popularity.

Comments (No)