Ethereum is a decentralized, open-source platform that underpins much of the cryptocurrency industry. Ethereum’s technology is used in everything from decentralized finance (DeFi) applications to non-fungible tokens (NFTs) to enterprise blockchain solutions.

However, Ether is currently retesting a key resistance zone in preparation for a possible retreat towards $1,800.

It took only two months for Ethereum’s native token, Ether (ETH), to rebound from a devastating selloff at the start of 2022.

The price of Ethereum breaks out, but hazards still exist

After rebounding by more than 30% in only two weeks and more than 50% from its year-to-date low of roughly $2,160 on Jan. 24, the price of Ethereum hit near $3,350 on March 28.

The ETH/USD pair may have also “busted” what appeared to be a bearish continuation formation known as the “symmetrical triangle” in the process.

“Busted patterns (when the price breaks out in one way only to reverse and break out in the opposite direction) frequently result in large swings,” writes Tom Bulkowski, an experienced market watcher. This gives reason to believe that Ether will rally to the target of the triangle pattern, which is approaching $4,000, in the next few days.

ETH conceal Risks

According to the market analyst, symmetrical triangles have a tendency to “double-bust,” meaning that the ultimate breakout direction is the same as the initial.

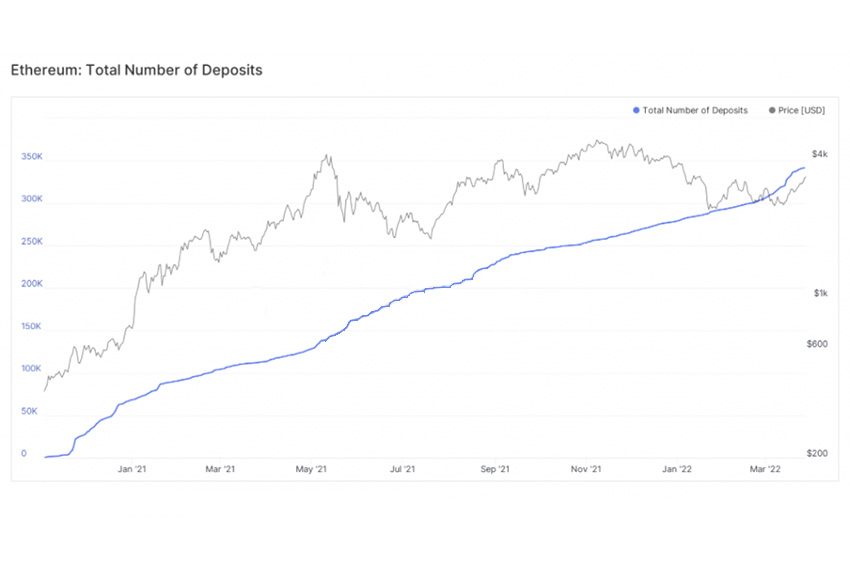

A double-bust scenario implies that Ether’s uptrend will soon exhaust, resulting in a reversal toward the top of the symmetrical triangle. As illustrated in the chart below, ETH is retesting its support-turned-resistance range, which functioned as a selloff region for traders in the January–February session.

As a result, another selloff in the range might cause double-bust risks, sending Ether’s price plummeting toward the symmetrical triangle’s downside objective of $1,800, which was calculated by adding the largest distance between the triangle’s upper and lower trendlines to the breakout point.

Interestingly, during the May–July 2021 selloff, the $1,800 mark was critical in restraining Ethereum’s attempts to fall.

If the price climbs firmly over the resistance zone, the double-bust scenario will be invalidated. According to PostXBT, an independent market expert, if levels around $3,350 are flipped back to support, ETH’s chances of reaching $4,000 are increased

Ethereum’s Upside Catalysts

The Ethereum Beacon Chain’s fusion with the Kiln testnet signalled that Ether’s blockchain would switch completely to a proof-of-stake network by summer 2022, heralding the start of Ether’s 30 percent recovery bounce.

Speculators have been anticipating Ethereum’s upgrade to ETH 2.0 for quite some time, as the upgrade promises to make transactions cheaper and more efficient.

In theory, it would be accomplished by providing network participants with carrot-and-stick incentives to collaborate, such as requiring them to “stake” 32 ETH for 18 months in order to become validators. In exchange, they would receive the same annual yields

As a result, many analysts believe that the price of Ether will climb as supply drops, especially if demand remains constant or rises.

Simultaneously, due to its close association with the US stock market and Bitcoin, Ether still faces downside risks (BTC). As previously said, BTC’s stock correlation is being keen monitored this week as BTC/USD tests major resistance levels.

Ether’s value as a digital currency is far more volatile and unpredictable than Ethereum’s technological advancements. You may reduce some of that risk by taking precautions against hacking, but the value of any investment directly linked to Ether is likely to vary in the long run.

Comments (No)