As the US tax season comes to an end, Bitcoin (BTC) has broken through important price support to strike one-month lows.

According to CoinDesk data, the most valuable cryptocurrency sank to $38,577 during Asian hours, a figure last reached on March 15. $40,000 was critical support, according to analytics firm IntoTheBlock, because considerable purchasing activity had occurred around that level this season. Since testing the seas above $48,000 three weeks ago, the cryptocurrency has lost nearly 17% of its value.

Tax-related sales and a shaky macro backdrop appear to have contributed to the market’s downfall. The deadline for submitting 2021 tax returns or requesting an extension to submit and pay a tax is Tuesday, April 18, 2022 for U.S. investors. Market participants liquidated virtual currencies during the tax time last year, between January 1 and April 15, according to David Duong of Coinbase in a recent daily email.

In a Telegram discussion, Jeff Anderson, CIO of statistical trading company and liquidity supplier Folkvang Trading, remarked, “Tax-related selling has undoubtedly had a role in recent weeks.” “However, it’s hard to say that much of the deterioration is due to the approaching tax deadline.”

“People were positioning for an expiration of tax selling Monday,” Anderson said, “but constant hike in yields has quashed that.”

According to data provided by graphing platform TradingView, the 10-year Treasury note yield increased to 2.88 percent early Monday, the highest rate since December 2018. Due to strong inflation and the Federal Bank’s promises to offer rapid-fire rate hikes, nominal exchange or inflation-adjusted U.S. treasury yields have been on a rampage in recent weeks. As a result, risk assets, such as equity markets and cryptocurrencies, have been hammered.

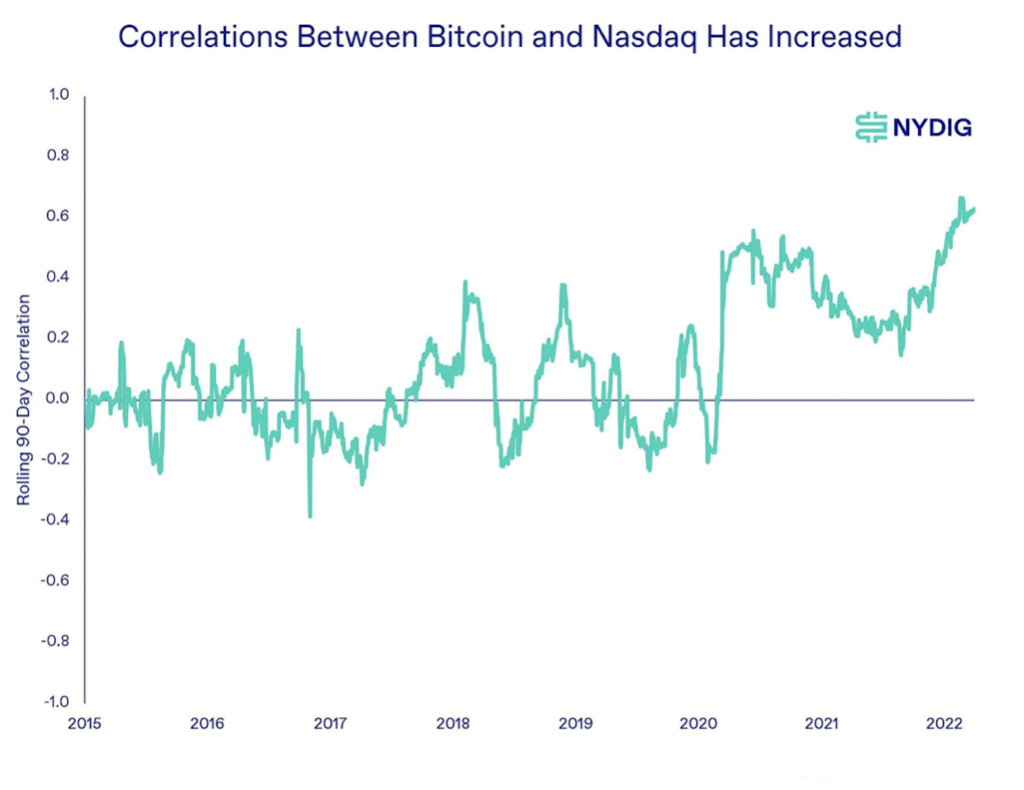

Bitcoin’s rising correlation to stocks, as per George Liu, may be the most important factor for the drop below $40,000.

Who is it that is selling?

The price pressure is most probably coming from brief traders with large holdings, according to blockchain statistics.

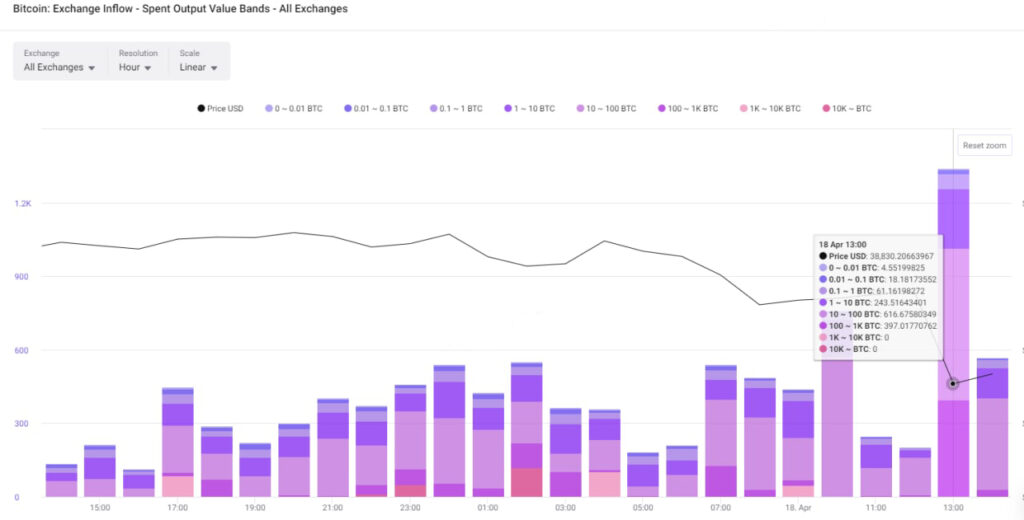

“Looking at the overall Bitcoin network movement from the spent output age band U.S. dollars and spent output value band USD, it appears that the group most active during the change in price seen a few hours ago was mostly 0 week elderly coins + UTXO volume in 1M+ USD,” Chan Chung, director of marketing at South Korean strategy analytics CryptoQuant, told CoinDesk in a Telegram conversations.

The wasted output age band is a collection of all spent outputs that entered into exchange wallets during a specific time period. According to Chung, most 0-1 week old coins were in circulation on Monday, indicating that short-term traders were likely to blame for the selling pressure.

Furthermore, the wasted output value range, which depicts the allocation of all wasted outputs based on their value, reveals that the majority of the bitcoins that entered exchanges early this morning were from the 10-100 BTC, 100 BTC, and 1,000 BTC groups. However, the data can be interpreted in a variety of ways, and blockchain analytics have their own set of constraints. For years, large coin hoarders can keep their stack in many addresses. “Whales may have divided their wallet yesterday, giving it the appearance of a one-day UTXO when, in actuality, it may have been matured for more than two years,” Chung explained.

Market flows in the derivatives market are bearish

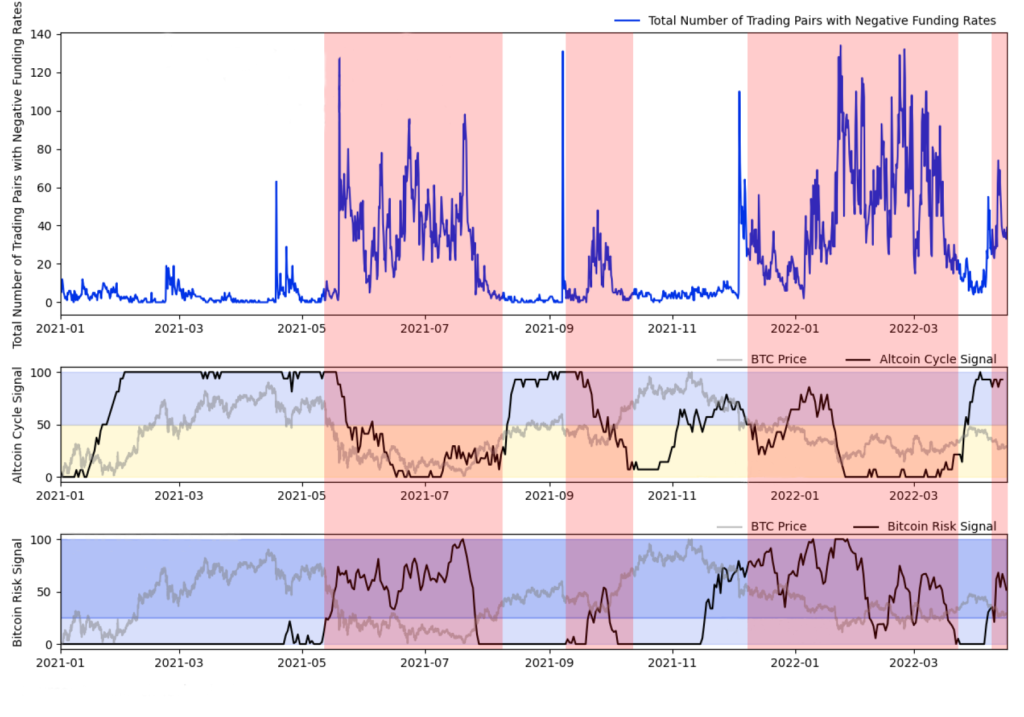

As demonstrated by rising lay skews, which assess the value of puts contrasted to calls, derivative traders appear to be planning for a sustained slide in bitcoin.

Short interest in the capital continuous futures market is increasing, according to Babel’s Liu, as is demand for downside hedging. To put it another way, investors appear to be banking on a decline.

As per data from Coinglass.com, this could be because financing rates, or the expense of holding long and short holdings in the continuous futures market, have declined sharply.

“Selling pressure reappeared in the annual market as bid trades outpaced ask transactions,” according to Glassnode’s April 17 Uncharted email.

Hope still survives in the cryptocurrency market as high or low are the integral part of the trading market. Investors still keep on investing despite the huge weekly fall with the same kind of enthusiasm and zeal.

Comments (No)